Read this content HERE

Buyers are back! We are finally seeing a pickup in activity after 10 slow months.

Since June last year, the Fed increased mortgage rates and spread the word around a recession, creating an artificial wall between buyers and the market. In January, things started to shift. So, what’s happening in Manhattan’s real estate market these days?

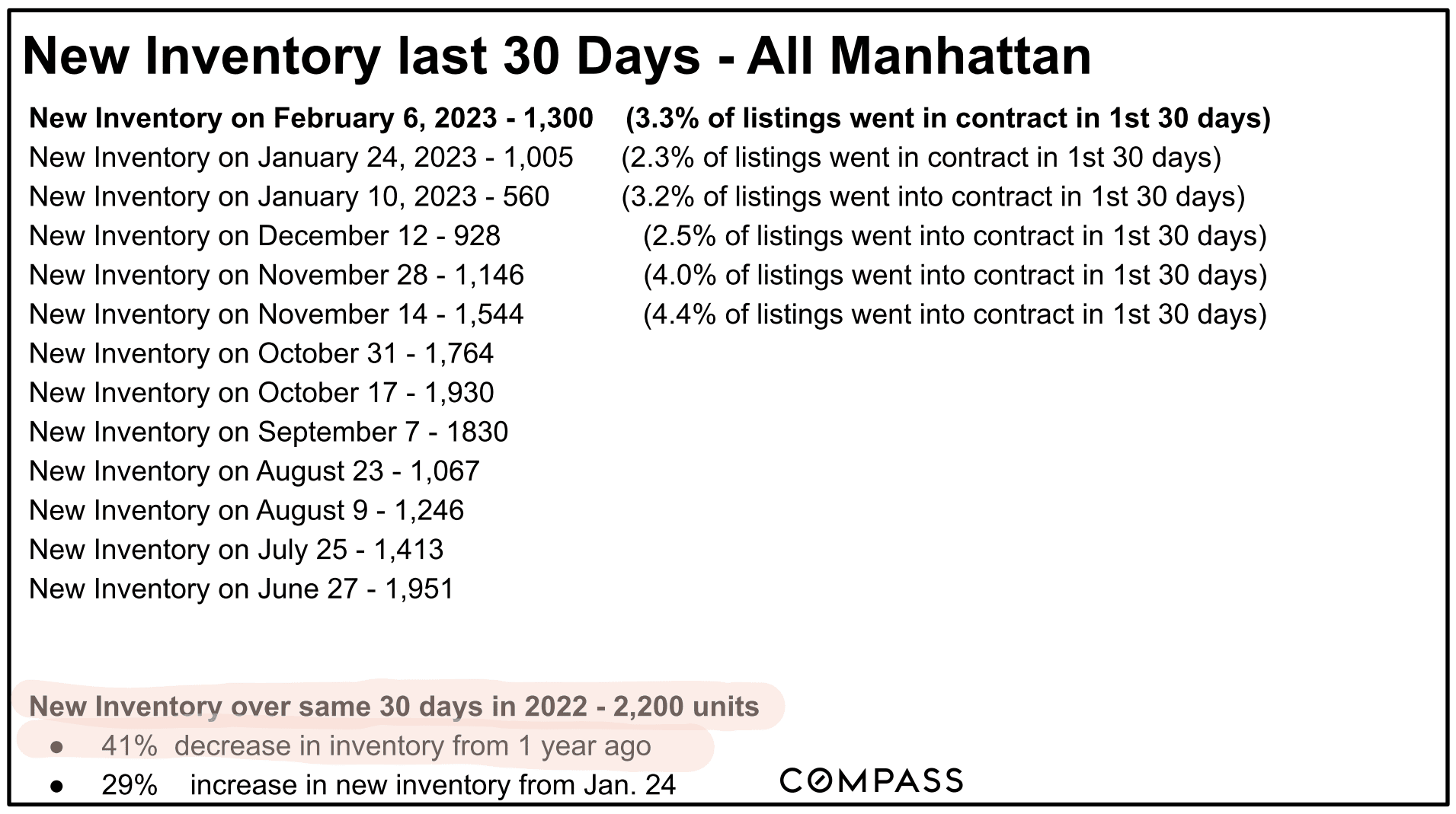

New inventory is down 41% from a year ago and current inventory is about the same as last January – still a little quiet in Manhattan but properties are coming back on the market.

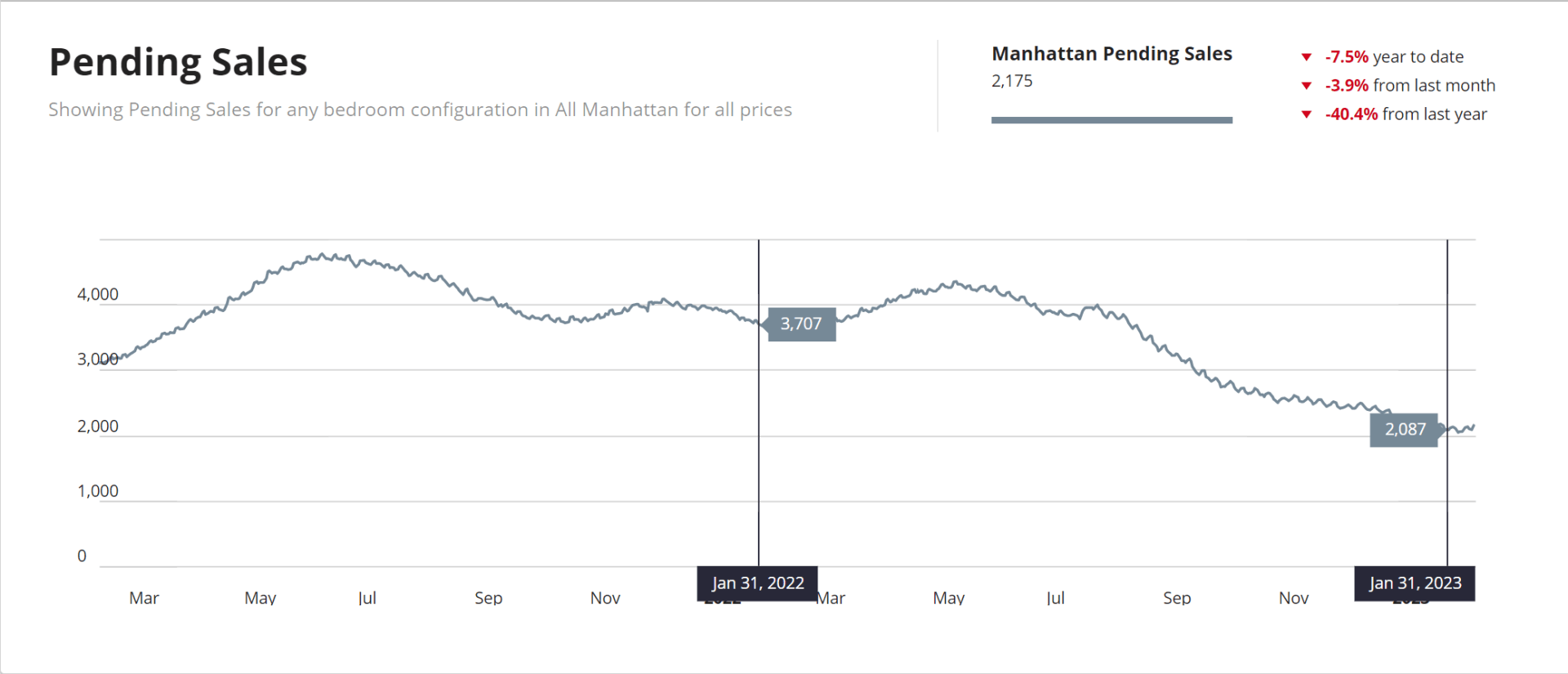

Pending sales have been going down from last year’s levels, however, in the first week of January we had 130 units going to contract, on the 2nd week 150 contracts, 3rd week 177 contracts, and on the 4th week 188 units had a contract signed. Side note, that in the first week of February 213 units went to contract. These numbers are still slightly below market average but once they meet average numbers or above, it’s Game On: the market will be active, and we will see more bidding wars and prices moving up.

Source: UrbanDigs

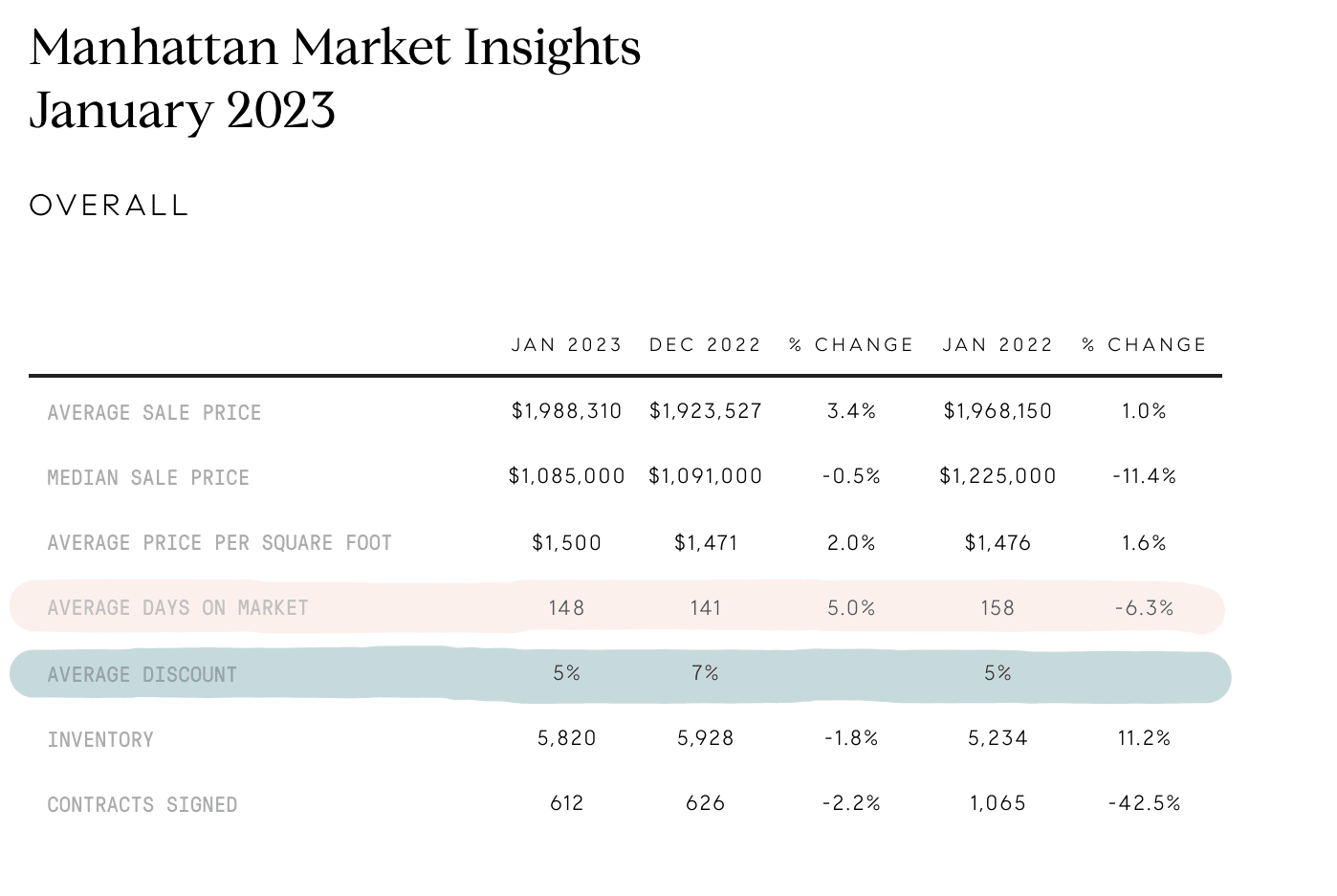

Days on the market are up 9% and prices overall remained the same.

Listing discount is slightly up from last month, now at 4.7%

Source: Compass Manhattan Market Report

Here is some interesting data: In the last 6 months we have seen the highest amount of off market units. What does it mean? Well, between 2016 and today we have been seeing some price resistance which slows down the market. Sellers don’t want to give in to buyer hesitancy and prefer to take their units off market and wait it out for the market to get better. They have no urgency to sell.

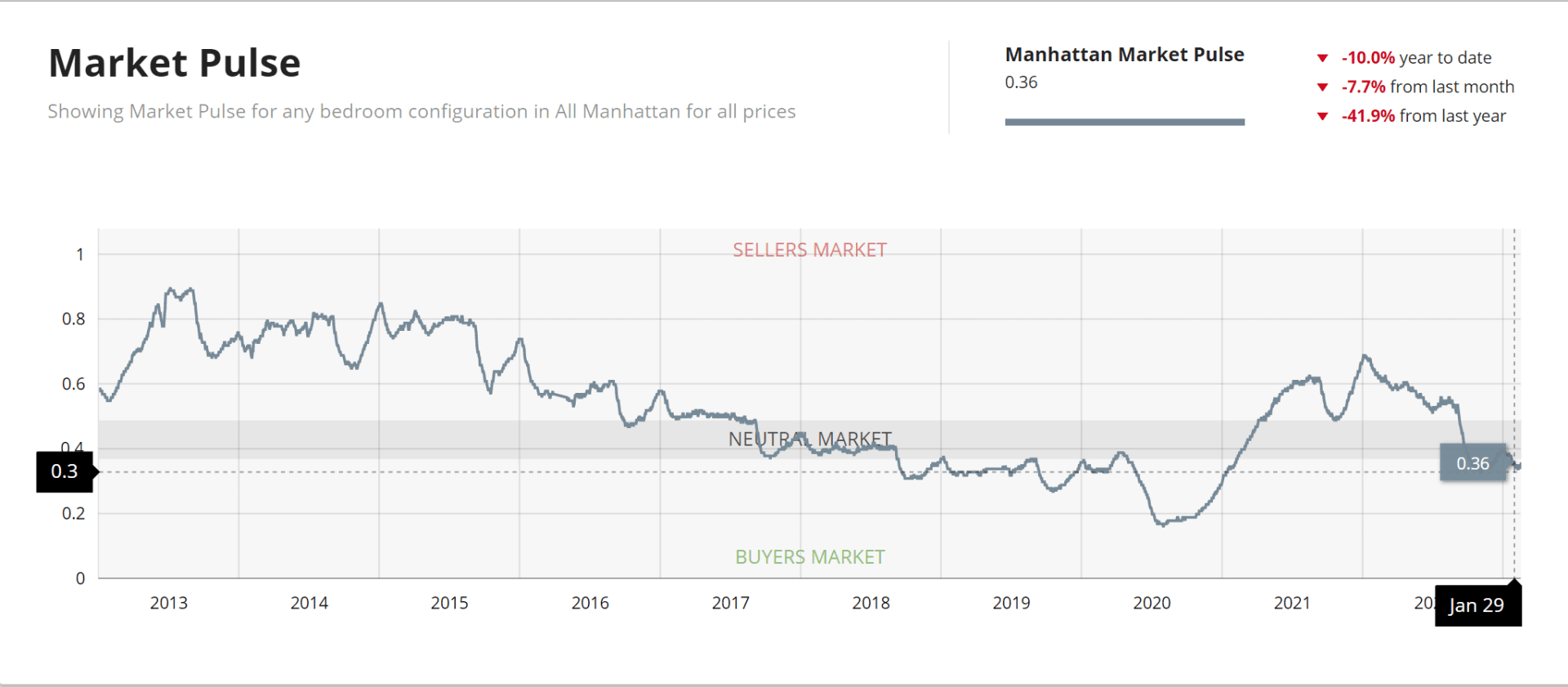

In terms of market pulse, it is still flat: inventory has gone up, but the number of signed contracts has also increased.

Source: UrbanDigs

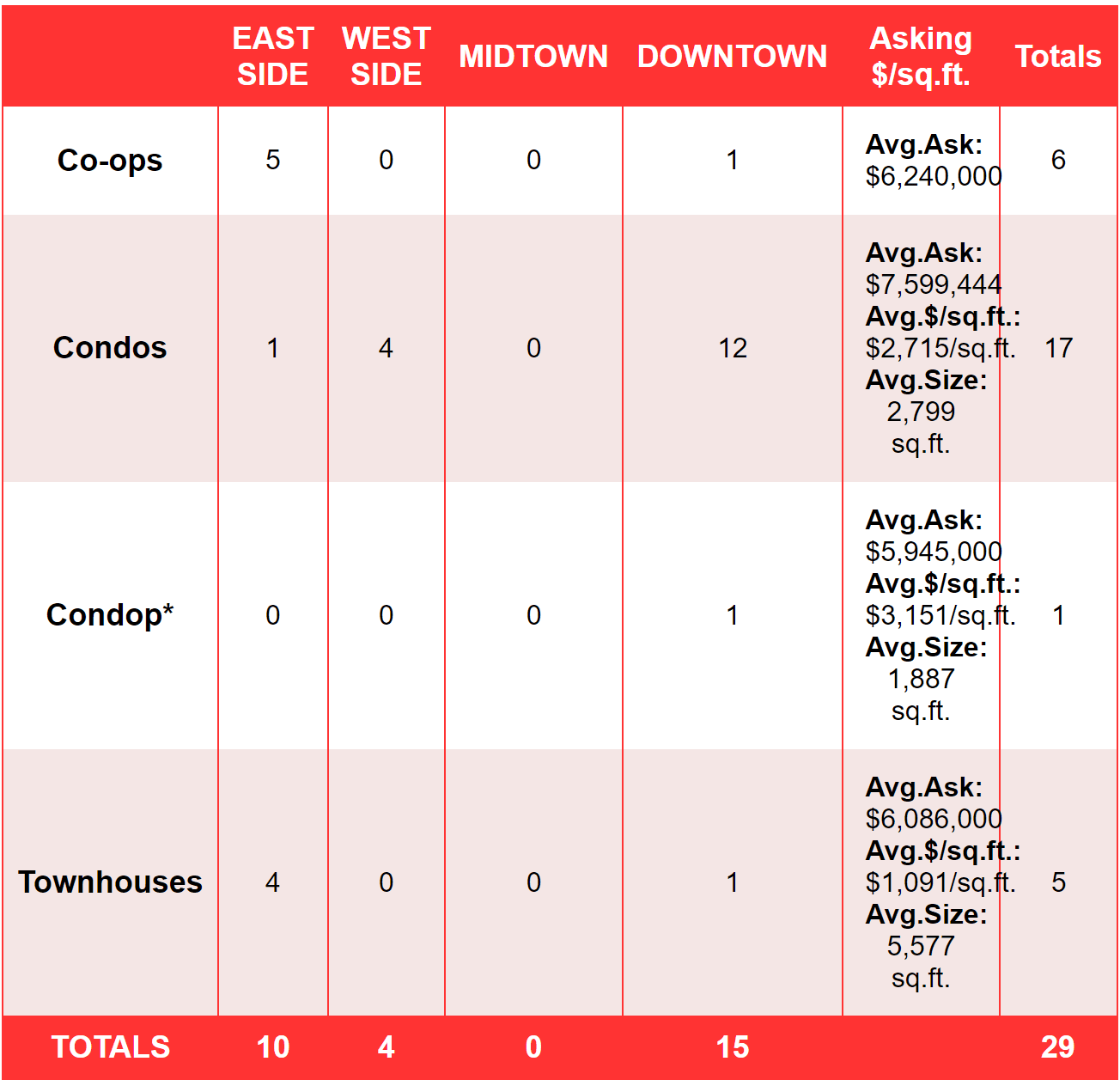

In the luxury market, above $4M, the Olshan report documented 29 contracts in the first week of February. The last time this happened was May 6th of 2022.

Source: Olshan Luxury Market Report

Overall, January is when we started to see a recovery in the market and a move towards healthy activity. The fear that more buyers will come to the market and that interest rates will go up again is starting to sink in. We hit bottom in the last quarter of 2022, so Fall was the last great opportunity to be a buyer. This winter is a good time to buy and from here it will only get more competitive.